How to File an Arizona Annual Report

Arizona requires an Annual Report to be file by corporations only. You can do it yourself. We’ll show you how.

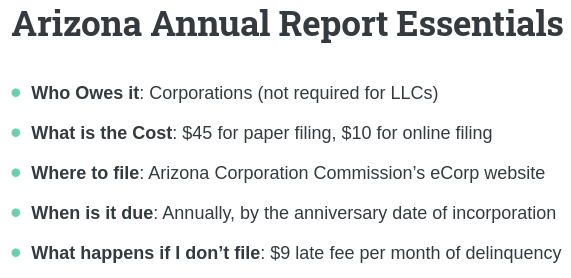

Arizona Annual Reports Overview

Annual reports provide updates on your company’s current information, ensuring compliance with state regulations, and helping the state track business activities. Note that LLCs in Arizona are not required to file annual reports.

File Your AZ Annual Report Online

Step-by-Step Guide to Filing Your Annual Report Online

Step 1: Log in to Your Account

Log in to your account on the Arizona Corporation Commission’s eCorp website. If you don’t have an account, it’s easy to create one. You just need an email address. Once in, click “ File Corporation Annual Report.

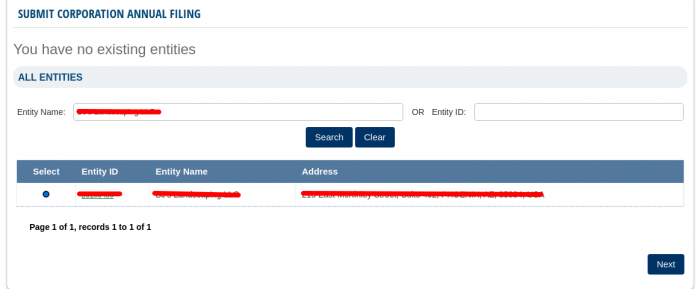

Step 2: Locate Your Business Entity

Search for your business entity using the search bar, entering your company’s name or entity number. You do not need your entity number to do this.

Step 3: Select Your Entity

On the next screen, select the “File Annual Report” Option Once you have located your business entity. Click on the “File Annual Report” option to start the process.

Step 4: Update and Verify Information Review the pre-filled information and update any necessary details, such as changes in address, registered agent, or management.

Step 5: Electronically Sign and Date the Annual Report Verify the information on the annual report, and electronically sign and date the document.

Step 6: Pay the Filing Fee Complete the filing process by paying the required fee, $10 for online filing, using a credit or debit card.

Deadlines and Filing Fees

The deadline for filing your annual report in Arizona is annually, by the anniversary date of incorporation. The cost of filing the report is $45 for paper filing and $10 for online filing.

Consequences of Filing Late

If you fail to file your annual report on time, you may be subject to late fees and penalties. Late filing may also put your business at risk of administrative dissolution, which means the state could dissolve your corporation.

Required Information for Your Arizona Annual Report

Here’s all the information you’ll need to have when filing:

- Business Name and Address

- Registered Agent Name and Address

- Business Structure (Corporation)

- Names and Addresses of Directors and Officers

Maintaining Compliance and Good Standing

By filing your annual report on time, you will maintain compliance with state regulations and ensure that your corporation remains in good standing with the state of Arizona.

Arizona Annual Report Frequently Asked Questions

This requirement pertains to foreign corporations (companies incorporated outside of Arizona) doing business in Arizona. The “Foreign Corporation’s Arizona Known Place of Business Address” is the official address that the corporation uses in Arizona. This could be the corporation’s physical office location, a registered agent’s address, or a PO box if applicable. The address is crucial as it serves as a contact point for the Arizona Corporation Commission and is required to be listed in the annual report.

SB 1244, enacted by the Arizona legislature, removed the requirement for nonprofit corporations to file annual reports with the Arizona Corporation Commission. This simplifies the annual administrative tasks for nonprofits, reducing their paperwork and regulatory burden. However, it’s crucial to note that while nonprofits are no longer required to file annual reports in Arizona, they must still maintain up-to-date records and be prepared to make these available upon request by relevant regulatory bodies.

Limited Liability Companies (LLCs) in Arizona are required to list their member or manager structure in their annual reports. If this information is not kept up-to-date and an LLC fails to correct its records, the Arizona Corporation Commission could administratively dissolve the company. If a company is administratively dissolved, it no longer enjoys the legal protections and benefits of being an LLC. It’s crucial, therefore, for an LLC to maintain its member structure information accurately to prevent potential legal and operational complications.